Genius Yield Interview

In today's interview Dr. Lars Brünjes, CTO of Genius Yield, discusses their Cardano-based DEX project, which focuses on transparency and community. They chose Cardano for its scientific approach and decentralized philosophy. Genius Yield's order book DEX leverages the EUTxO model for efficiency. Security is ensured through audits and open-sourcing of key components like Market Maker Bots. The project includes a Fee Sharing Program and exciting future developments like Smart Swaps and AI-Powered Smart Liquidity Vaults. Sounds Exciting? Well..lets dive right in!

Hey, Dr. Lars Brünjes, happy to connect today and learn more about Genius Yield. Can you tell us more about the project and the problem you were addressing?

Hi there, I'm delighted for this opportunity to talk about Genius Yield and share our vision. Genius Yield is conceived as a next-generation decentralised exchange (DEX) on the Cardano blockchain, aiming to address the pain points in decentralised finance (DeFi) and provide a more optimised, user-friendly experience. We're tackling the issues of complexity and inefficiency that often plague DeFi platforms, making them intimidating for average users and leading to suboptimal capital allocation.

A cornerstone of Genius Yield is our commitment to becoming the 'Community DEX.' We're putting a strong emphasis on ensuring transparency, which is why we're dedicated to open-source as much of our code as possible. We believe that by doing so, we will foster a sense of trust and collective ownership with our users and help the whole Cardano ecosystem by not forcing every single project to reinvent the wheel.

We want the community to feel involved and empowered to suggest, scrutinise, and contribute to the project's development, ensuring that Genius Yield remains aligned with the needs and values of its users. Our mission is clear: to create a platform that balances decentralisation, security, usability, and performance while upholding the principles of transparency and open collaboration that are so vital in the crypto space in general and on Cardano in particular.

What is your role within Genius Yield, also can you tell us a bit about yourself? s CTO of Genius Yield, my primary responsibility is to guide the technical aspects of our project to success. I oversee the development of our decentralised exchange with special emphasis on our smart contracts.

A bit about myself: My academic career in pure mathematics laid the foundation for my approach to problem-solving and my passion for functional programming languages like Haskell, which I've carried over into the blockchain space.

Joining IOHK (now IOG) was a pivotal move in my career, allowing me to dive deeply into blockchain technology and demonstrate educational leadership via IOG’s Haskell courses and the Plutus Pioneer Program. What I've found is that in order to truly master something, you must teach it. My work as Director of Education at IOG has "forced" me to become an expert in topics I would otherwise not be exposed to. This requirement to constantly learn and explain complex concepts in a more digestible manner has been instrumental in my development, both as an individual and as the CTO of Genius Yield. Moreover, my hands-on experience with real-world problems at Genius Yield provides invaluable practical insight that I bring back to my educational role — it keeps my teaching grounded, relevant, and up-to-date.

This synergy between education and application is critical. It allows me to stay at the forefront of blockchain technology developments, ensuring that I'm always learning and applying the latest and most effective methods. It's a virtuous cycle: my teaching informs my practice, and my practice fuels my teaching. This dynamic is what helps me to steer Genius Yield in the direction that will most benefit the Cardano community and the wider world of decentralised finance.

What motivated Genius Yield to launch its order book DEX on the Cardano Blockchain?

Genius Yield's decision to launch its order book DEX on the Cardano blockchain was influenced by a blend of scientific rigour and a strong commitment to decentralisation.

The scientific foundation of Cardano, with its peer-reviewed research and evidence-based development, aligns with our core principle of creating robust and reliable financial products. The emphasis on formal methods and high-assurance programming ensures the security and correctness that a decentralised exchange requires.

Simultaneously, Cardano's unwavering dedication to decentralisation resonates with our vision of a fair and open financial ecosystem. Decentralisation is not just a feature—it's a core value and building block that promotes equality, resilience, and community governance. This commitment reflects Cardano's distributed architecture, which reduces central points of control and empowers users across the network.

By integrating these foundational principles with the technological efficiency of Cardano's proof-of-stake consensus and its extended UTXO model, we can provide users with a DEX that is not only user-friendly and cost-effective but also one that is secure, scalable, and in tune with the ethos of a decentralised future.

We believe our platform will significantly benefit both the Cardano community and the wider world of decentralised finance, living up to our shared ideals of inclusivity and performance.

Can you briefly explain what distinguishes Genius Yield's order book DEX from other Dexes? What benefits does it offer that others don't?

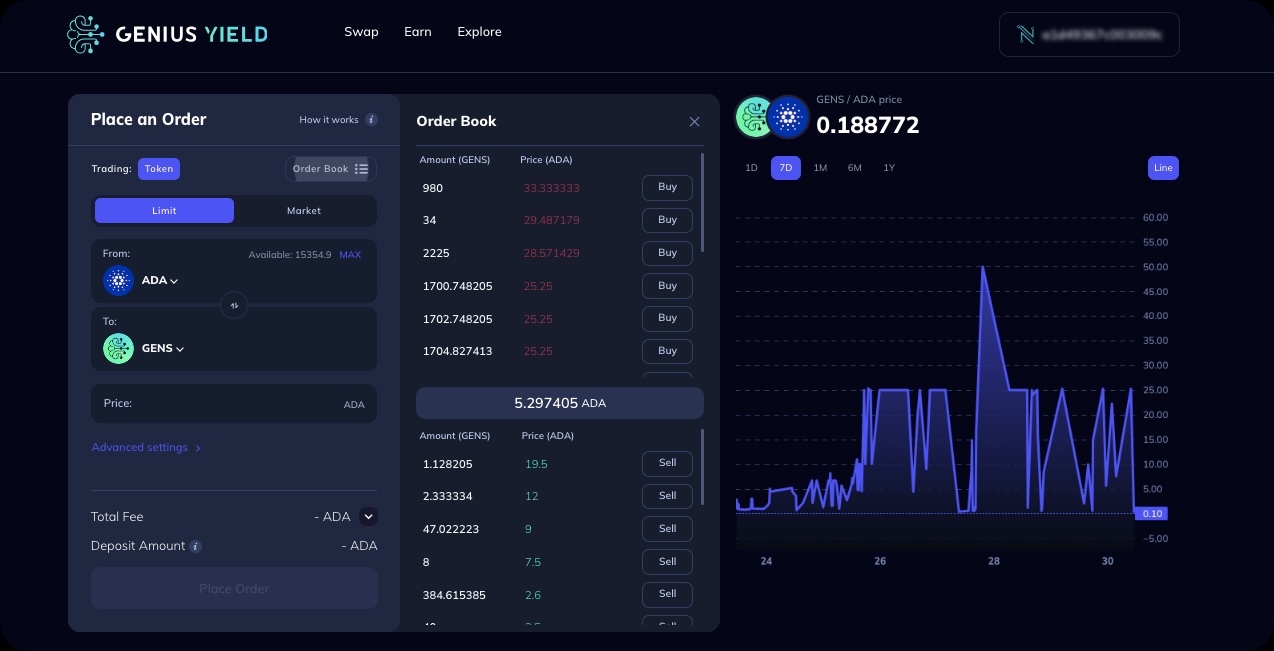

Genius Yield's order book DEX is innovative because of its full embrace of the EUTxO model, rather than simply importing concepts from Ethereum's account-based model. This critical decision enables our DEX to process multiple orders for the same trading pair in one block, across independent transactions. This is a marked improvement over AMM DEX's that rely on batchers to consolidate transactions due to the contention for a single UTxO representing a trading pair.

This design allows for another significant advantage: the ability to fill orders in a single transaction. This is a critical aspect that enhances the efficiency and user experience. By eliminating the need for batchers, we can streamline the trading process, making it faster and more cost-effective for users. This for example enables third-party projects to integrate our DEX seamlessly. For instance, they can offer payments in various tokens, not just ADA, by leveraging our infrastructure.

This not only demonstrates the flexibility of our platform but also emphasises our commitment to serving as a foundational layer for the burgeoning DeFi landscape on Cardano, which can be built upon and extended by developers and entrepreneurs to create new and innovative financial applications.

Moreover, our commitment to openness and transparency in the DeFi space is paramount. At Genius Yield, we have made it possible for anyone to participate fully in the ecosystem we're building. Not only can users place and fill orders without utilising our user interface, but they can also operate Smart Order Routers and run Market Maker Bots (MMBs). This openness fosters an inclusive environment where the community is empowered to engage with the system at multiple levels, contributing to a robust and resilient financial ecosystem on the Cardano blockchain.

Being the “Community DEX”, we not only strive for openness and transparency by open-sourcing whatever we can, but we also give back to our community with our Fee Sharing Program.

All these efforts are part of our broader goal to democratise finance: to make it more accessible, efficient, and fair for everyone. We are excited about the potential of what we're creating with Genius Yield and are optimistic that it will drive a new wave of innovation in decentralised finance.

[ ]

]

What measures are in place to prevent possible attack vectors and manipulation, such as front-running within the Genius Yield order book DEX?

We are most proud of our rapid re-design of our App, following the valuable feedback from our Beta testers, as well as industry leaders and professionals.

Front-running in the context of a DEX could occur if someone sees a trade about to be made and quickly makes their own trade ahead of it, to profit from the price movement they anticipate. The design of Genius Yield's order book DEX inherently reduces the risk of such activities. Without batchers, we remove a layer where front-running could potentially occur, as trades are directly and individually executed on the blockchain. Additionally, one of the strongest measures we have in place to prevent not just front-running, but a wide array of attack vectors and manipulations, is the thorough auditing of our smart contracts.

We are committed to ensuring that our code is secure and reliable, hence we engage in rigorous auditing processes conducted by reputable third-party firms. This helps us identify and resolve potential security issues before they become a problem. We will also open-source all our smart contracts. By doing this, we invite developers and security experts from all around the world to scrutinise our code openly.

This form of transparency is instrumental in gaining the confidence of the community, as it allows for peer review and community-driven improvements. It's an important step that demonstrates our commitment to creating a safe, secure, and trustworthy trading environment on the Cardano blockchain.

Decentralization is truly a building block of Cardano. Can you elaborate more on Genius Yield’s open-sourced Market Maker Bots (MMBs) and Smart Order Routers (SORs)?

The SORs are integral in ensuring quick order execution and in helping narrow the bid-ask spread, which is a benefit to all users trading on the platform.

The open-sourcing of these components is pivotal because it allows for a diverse set of participants to run their own SORs and MMBs. This is not only aligned with the decentralised ethos of Cardano and Genius Yield, but it also creates a robust system where market efficiency is enhanced by competing parties striving to capitalise on profit opportunities. The ultimate result is a more fair and efficient market, where users benefit from improved liquidity and faster execution.

In our efforts to democratise the creation and implementation of trading strategies, we are developing a Bot API for our Market Maker Bots. This will shift strategy development to accessible programming languages such as Python and TypeScript, via an easy-to-use REST API. It’s essential for fostering a community where anyone can build and share their strategies, ultimately leading to a rich ecosystem of trading strategies available for all to employ.

Looking forward, we are excited about the prospect of introducing a Bot UI, which will make it even easier for users to manage, explore, and showcase trading strategies. This will be a space where both experienced traders and newcomers can interact with the bots, leveraging the collective intelligence of the community for personal and communal gain.

Finally, the robustness of an open-source approach cannot be overstated; it indeed strengthens the entire system. By encouraging multiple independent parties to run their own bots, not only do we mitigate centralised risks, but we also nurture a competitive environment that naturally filters through to efficient and resilient market infrastructure.

Let’s say an individual would like to build their own MMB or SOR? Where would you recommend they start? Do you offer any support?

I think the best places to start are the GitHub repositories for SORs and MMBs here and here. We also have a dedicated channel on our Discord where you can join your fellow bot operators and our developers in discussions and ask your questions.

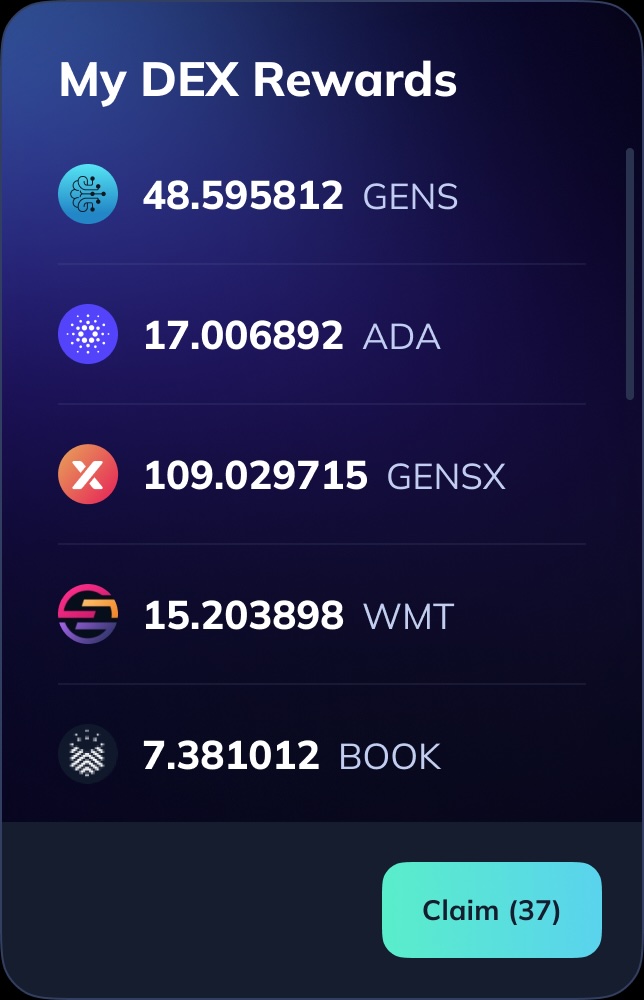

You mentioned your DEX's "Fees Sharing Program", can you give more details about it? What tokens do you share with your community, how often are distributed, etc

We are sharing 20% of our DEX fees with our GENS stakers every week. DEX fees come in the form of all tokens traded on our DEX, so the weekly rewards are a colourful, mixed bag of almost 40 different tokens! You can read more about the GENS staking program here.

[ ]

]

What does the future hold for Genius Yield? For example, what new developments or features should we expect in the next 6 to 12 months, and what will this mean for the overall project?

Update of the GENS Staking Program - we move away from fixed APY on GENS to an anticipated APY boost on DEX fee sharing (20% of DEX fees come back to GENS stakers). Additionally, we expand the program and add a flex staking option.

DEX smart contract open-sourcing — continuing with transparency, we plan to open-source the smart contracts of the DEX

Market Maker Bots framework — the feature that will give liquidity providers flexibility in employing different trading strategies when managing their funds.

Aggregated order book - this feature will allow users to view an aggregated representation of the order book, grouping by various price options.

Smart Swaps — advanced order types that allow for flexibility and modularity, with the potential to provide sophisticated trading functionalities.

AI-Powered Smart Liquidity Vaults (SLVs) - AI-powered algorithmic strategies that will leverage Genius Yield’s Market Maker Bots and Smart Swaps features. SLVs will automate users’ yield optimization strategies and unlock the additional opportunity to earn passive rewards.

Leaderboard and custom Smart Liquidity Vaults strategy sharing — details will be provided at a later stage.

Tell us about your team. Who are the people behind organization/company/project?

-

Laurent Bellandi: Chief Executive Officer & Co-Founder

Laurent is a serial entrepreneur, for the last over 20 years focused on digital/online businesses. He co-founded both Genius Yield, one of the most innovative DeFi protocols on Cardano, and Genius X, an accelerator program for the most innovative blockchain startups. LinkedIn -

Dr. Lars Brünjes: Chief Technology Officer & Co-Founder

Lars is a mathematician and Haskell developer. As Director of Education at Input Output Global (IOG), the engineering research company behind the development of the Cardano blockchain, Lars has taught thousands of people how to build smart contracts. As Chief Technology Officer of Genius Yield and Genius X, Lars leads research & development with the technical team and has written the smart contract code for the Genius Yield platform. LinkedIn -

Dr. Sothy Kol-Men: Chief Regulatory Officer & Co-Founder

Sothy has over 20 years of experience in digital finance, investments, building new ventures, and regulation. He is a legal expert, guiding Genius Yield and Genius X through legal and regulatory matters for fintech rules and regulatory compliance. Sothy is also a highly regarded professional in the Swiss and European crypto networks. LinkedIn -

Marvin Bertin: Chief Scientific Officer & Co-Founder

Marvin is an Artificial Intelligence / Machine Learning engineer who spent years working in biotech on early cancer detection blood tests using next-generation DNA sequencing. Later he worked as a senior crypto consultant, developing DeFi products for clients on the Ethereum and Cosmo blockchains. Marvin, along with Dr. Lars Brünjes, co-leads research & development for the Genius Yield and Genius X projects. LinkedIn